GET PRIORITY ACCESS TO OUR UPCOMING INVESTMENT OPPORTUNITIES BY JOINING OUR INVESTOR'S CLUB.

ATTENTION: real estate investors

SW CAPITAL

Helping Investors Achieve Financial Freedom Through Commercial & Multifamily Investing

Free to Join – Learn, Connect, Invest at Your Own Pace

Syndication Snapshot

Join our elite group of investors and mentors that are laser focused on one goal: Achieving Financial Freedom

Invest In Top Tier Markets

We empower individuals to achieve financial freedom by investing in apartment buildings in top-tier markets across the country. Our dedicated team leverages our deep expertise in the industry along with our data-driven process to consistently identify, acquire, manage, stabilize, optimize, and divest cash-flowing, value-add Class B and C properties.

Diversify Your Portfolio

Minimize Risk

Maximize Returns

Achieve Financial Freedom

Free to Join – Learn, Connect, Invest at Your Own Pace

Our Portfolio

Regatta Apartments

200 Units | San Antonio, TX

2024 | Cash Flowing

Driftwood Apartments

100 Units | Corpus Christi, TX

2024 | Cash Flowing

Rufus Apartments

12 Units | Hammond, LA

2020 | Cash Flowing

Cypress Park Offices

7,020 SqFt | Prairieville, LA

2022 | Cash Flowing

Towne Park Offices

6,228 SqFt | Prairieville, LA

2015 | Cash Flowing

APR Warehouse

6,600 SqFt | Gonzales, LA

2006 | Cash Flowing

SFR Rental Portfolio

11 Units | $3.6M | Cash Flowing

SFR Developments

90 Units | $52.2M | Full Cycle

Spanish Key Condo

$900K | Perdido Key, FL

2013 | Cash Flowing

Bella Luna Condo

2.05x EM | Orange Beach, AL

Acquired 2015 | Exited 2021

Manorway Mobile Home Park

50 Units | Gonzales, LA | EM

Acquired 1998 | Exited 2002

Oakwood Estates Mobile Home Park

45 Units | Sorrento, LA | EM

Acquired 1999 | Exited 2002

Fitness Center Portfolio

12,620 SqFt | Louisiana/Mississippi | 2.55x EM

Acquired 2009 | Exited 2016

Hurricane Katrina Rebuild

$1.5B | Construction Project Management

New Orleans, LA | 2009

Private Money Lending

Established 2024 | Cash Flowing

Asset Management

Established 1998 | Cash Flowing

Residential & Commercial Construction

Established 2013 | Cash Flowing

Real Estate Brokerage

Established 2015 | Cash Flowing

Transportation

Established 2022 | Cash Flowing

What Is A Syndication?

Unlock the Power of Collective Investing

A real estate syndication is a partnership where a group of investors pool their money together to purchase large assets that would otherwise be difficult for someone to acquire on their own. The typical structure consists of general partners and limited partners.

The General Partner, or syndicator, is responsible for overseeing and managing the property from acquisition, signing the loan, due diligence, renovation, and daily operations. They have full liability over the company and its decisions.

Limited Partners are passive partners who invest in a portion of the equity investment and typically are not involved in the daily responsibilities of the company and have no personal liability beyond their investment.

Free to Join – Learn, Connect, Invest at Your Own Pace

Investing In Real Estate Can Give You

Cash Flow

One of the biggest benefits of real estate investing is cash flow, meaning you receive passive income, without having to do any work.

Tax Advantages

With passive investing, you get huge tax advantages through accelerated depreciation, all without having to deal with the hassles of being a landlord.

Equity

The beauty of multifamily real estate is that the rental income covers the debt and expenses, meaning the tenants are helping you build equity.

Appreciation

Because we invest in value-add assets in growing markets, you get the benefit of appreciation, which means that you’re maximizing your returns.

Free to Join – Learn, Connect, Invest at Your Own Pace

Investing is a Simple 3-Step Process

Free to Join – Learn, Connect, Invest at Your Own Pace

Meet Our Team

Free to Join – Learn, Connect, Invest at Your Own Pace

Frequently Asked Questions

What is a Syndication?

Multifamily syndication is a collaborative investment strategy where a group of investors pools resources to purchase and manage large multifamily properties, such as apartment complexes. This allows investors to benefit from passive income and property appreciation without the responsibility of day-to-day management.

Why should I invest in multifamily real estate?

Multifamily real estate offers benefits like consistent cash flow, tax advantages, scalability, and diversification. It’s also considered a relatively stable investment compared to other asset classes.

How does real estate syndication differ from other real estate investments?

Unlike single-family rentals or small-scale real estate investments, commercial & multifamily syndication involves larger properties with multiple income streams and professional management, which can lead to more stable returns.

How do I get started with real estate syndication?

Start by joining our investor network. We’ll guide you through the education process, understand your goals, and introduce you to available opportunities that align with your interests.

What is the minimum investment amount?

The minimum investment typically ranges between $25,000 and $100,000, depending on the specific deal.

Do I need to be an accredited investor?

Many of our deals require investors to be accredited. This means having a net worth of over $1 million (excluding your primary residence) or earning an annual income of $200,000 ($300,000 for couples) for the last two years. However, some deals are open to non-accredited investors.

What is the typical timeline for an investment?

Most multifamily syndication deals have a holding period of 5 to 7 years, though this can vary depending on the property and business plan.

Free to Join – Learn, Connect, Invest at Your Own Pace

Copyrights | privacy policy | Terms & Conditions

ATTENTION: real estate investors

SW CAPITAL

Helping Investors Achieve Financial Freedom Through Commercial & Multifamily Investing

Free to Join – Learn, Connect, Invest at Your Own Pace

Syndication Snapshot

Join our elite group of investors and mentors that are laser focused on one goal: Achieving Financial Freedom

Invest In Top Tier Markets

We empower individuals to achieve financial freedom by investing in apartment buildings in top-tier markets across the country. Our dedicated team leverages our deep expertise in the industry along with our data-driven process to consistently identify, acquire, manage, stabilize, optimize, and divest cash-flowing, value-add Class B and C properties.

Diversify Your Portfolio

Minimize Risk

Maximize Returns

Achieve Financial Freedom

Free to Join – Learn, Connect, Invest at Your Own Pace

Our Portfolio

Regatta Apartments

200 Units | San Antonio, TX

2024 | Cash Flowing

Driftwood Apartments

100 Units | Corpus Christi, TX

2024 | Cash Flowing

Rufus Apartments

12 Units | Hammond, LA

2020 | Cash Flowing

Cypress Park Offices

7,020 SqFt | Prairieville, LA

2022 | Cash Flowing

Towne Park Offices

6,228 SqFt | Prairieville, LA

2015 | Cash Flowing

APR Warehouse

6,600 SqFt | Gonzales, LA

2006 | Cash Flowing

SFR Rental Portfolio

11 Units | $3.6M | Cash Flowing

SFR Developments

90 Units | $52.2M | Full Cycle

Spanish Key Condo

$900K | Perdido Key, FL

2013 | Cash Flowing

Bella Luna Condo

2.05x EM | Orange Beach, AL

Acquired 2015 | Exited 2021

Manorway Mobile Home Park

50 Units | Gonzales, LA | EM

Acquired 1998 | Exited 2002

Oakwood Estates Mobile Home Park

45 Units | Sorrento, LA | EM

Acquired 1999 | Exited 2002

Fitness Center Portfolio

12,620 SqFt | Louisiana/Mississippi | 2.55x EM

Acquired 2009 | Exited 2016

Hurricane Katrina Rebuild

$1.5B | Construction Project Management

New Orleans, LA | 2009

Private Money Lending

Established 2024 | Cash Flowing

Asset Management

Established 1998 | Cash Flowing

Residential & Commercial Construction

Established 2013 | Cash Flowing

Real Estate Brokerage

Established 2015 | Cash Flowing

Transportation

Established 2022 | Cash Flowing

What Is A Syndication?

Unlock the Power of Collective Investing

A real estate syndication is a partnership where a group of investors pool their money together to purchase large assets that would otherwise be difficult for someone to acquire on their own. The typical structure consists of general partners and limited partners.

The General Partner, or syndicator, is responsible for overseeing and managing the property from acquisition, signing the loan, due diligence, renovation, and daily operations. They have full liability over the company and its decisions.

Limited Partners are passive partners who invest in a portion of the equity investment and typically are not involved in the daily responsibilities of the company and have no personal liability beyond their investment.

Free to Join – Learn, Connect, Invest at Your Own Pace

Investing In Real Estate Can Give You

Cash Flow

One of the biggest benefits of real estate investing is cash flow, meaning you receive passive income, without having to do any work.

Tax Advantages

With passive investing, you get huge tax advantages through accelerated depreciation, all without having to deal with the hassles of being a landlord.

Equity

The beauty of multifamily real estate is that the rental income covers the debt and expenses, meaning the tenants are helping you build equity.

Appreciation

Because we invest in value-add assets in growing markets, you get the benefit of appreciation, which means that you’re maximizing your returns.

Free to Join – Learn, Connect, Invest at Your Own Pace

Investing is a Simple 3-Step Process

Free to Join – Learn, Connect, Invest at Your Own Pace

Meet Our Team

Free to Join – Learn, Connect, Invest at Your Own Pace

Frequently Asked Questions

What is a Syndication?

Multifamily syndication is a collaborative investment strategy where a group of investors pools resources to purchase and manage large multifamily properties, such as apartment complexes. This allows investors to benefit from passive income and property appreciation without the responsibility of day-to-day management.

Why should I invest in multifamily real estate?

Multifamily real estate offers benefits like consistent cash flow, tax advantages, scalability, and diversification. It’s also considered a relatively stable investment compared to other asset classes.

How does commercial & multifamily syndication differ from other real estate investments?

Unlike single-family rentals or small-scale real estate investments, commercial & multifamily syndication involves larger properties with multiple income streams and professional management, which can lead to more stable returns.

How do I get started with real estate syndication?

Start by joining our investor network. We’ll guide you through the education process, understand your goals, and introduce you to available opportunities that align with your interests.

What is the minimum investment amount?

The minimum investment typically ranges between $25,000 and $100,000, depending on the specific deal.

Do I need to be an accredited investor?

Many of our deals require investors to be accredited. This means having a net worth of over $1 million (excluding your primary residence) or earning an annual income of $200,000 ($300,000 for couples) for the last two years. However, some deals are open to non-accredited investors.

What is the typical timeline for an investment?

Most multifamily syndication deals have a holding period of 5 to 7 years, though this can vary depending on the property and business plan.

Free to Join – Learn, Connect, Invest at Your Own Pace

Copyrights | privacy policy | Terms & Conditions

About 1-Syndication Snapshot

Join our elite group of investors and mentors that are laser focused on one goal: Achieving Financial Freedom

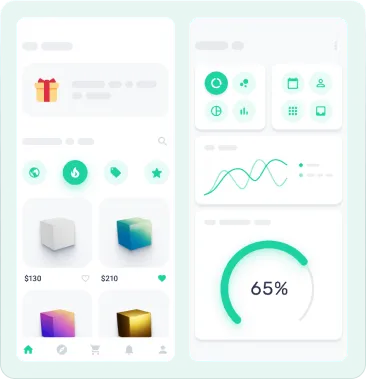

Performance

Lorem ipsum dolor sit amet consectetur don urna posuere.

Mobile Tools

Lorem ipsum dolor sit amet consectetur don urna posuere.

Dashboard to track KPI's

Lorem ipsum dolor sit amet consectetur don urna posuere.

Cancel Your Expensive Softwares

Lorem ipsum dolor sit amet consectetur eget vitae cras id nisi cras sed elit.

Say goodbye to these expensive softwares

Lorem ipsum dolor sit amet consectetur. Eget vitae including these expensive tools you can cancel:

Software 1 you can say goodbye to now

This one you can cancel too

And this one you no longer need

Plus many more

Time to switch & save now - get a free trial!

cancel anytime - no questions asked

Welcome to the future of all-in-one platforms

Lorem ipsum dolor sit amet consectetur. Eget vitae including everything you can now handle in one place:

Start and scale your online business

Manage all your leads in one simple place

Close more deals with ease

And deliver amazing experiences for your customers

Ready to experience the magic yourself? Try it free now!

cancel anytime - no questions asked

Replace Them All by Our Tool

Lorem ipsum dolor sit amet consectetur eget vitae cras id nisi cras sed elit.

cancel anytime - no questions asked

Simple Pricing

Lorem ipsum dolor sit amet consectetur eget vitae cras id nisi cras sed elit.

Premium Plan

Unlimited websites

Unlimited funnels

Unlimited automations

Unlimited forms

Unlimited surveys

Unlimited calendars

Unlimited pipelines

Unlimited leads

Unlimited courses

A/B split testing

And much more

14 Day Free Trial, After That:

$97/m

cancel anytime - no questions asked

See What Others Are Saying

Lorem ipsum dolor sit amet consectetur eget vitae cras id nisi cras sed elit.

"Best software on the market!"

Lorem ipsum dolor sit amet consectetur eget vitae cras id nisi cras sed elit.

"Saved so much by switching!"

Lorem ipsum dolor sit amet consectetur eget vitae cras id nisi cras sed elit.

"Best software on the market!"

Lorem ipsum dolor sit amet consectetur eget vitae cras id nisi cras sed elit.

"Saved so much by switching!"

Lorem ipsum dolor sit amet consectetur eget vitae cras id nisi cras sed elit.

Watch the Free Demo Video

cancel anytime - no questions asked

Frequently Asked Questions

Why is this different?

Lorem ipsum dolor sit amet consectetur. Eget vitae cras id nisi cras sed. Pulvinar vitae dui bibendum facilisi porttitor morbi. Quisque orci egestas a fermentum ultrices dolor libero.

What do I get when I sign up?

Lorem ipsum dolor sit amet consectetur. Eget vitae cras id nisi cras sed. Pulvinar vitae dui bibendum facilisi porttitor morbi. Quisque orci egestas a fermentum ultrices dolor libero.

What if I get stuck and need help?

Lorem ipsum dolor sit amet consectetur. Eget vitae cras id nisi cras sed. Pulvinar vitae dui bibendum facilisi porttitor morbi. Quisque orci egestas a fermentum ultrices dolor libero.

Can I cancel anytime in the software?

Lorem ipsum dolor sit amet consectetur. Eget vitae cras id nisi cras sed. Pulvinar vitae dui bibendum facilisi porttitor morbi. Quisque orci egestas a fermentum ultrices dolor libero.

cancel anytime - no questions asked

Copyrights 202X | YourBrand.com | Terms & Conditions